2本のEMAを利用したゴールデンクロスとデッドクロスに優位性はあるのかを検証してみました。移動平均線のメジャー期間である20、21、25から、マイナー期間 (期間1~200) まで幅広く最適化をしながら良い組み合わせから悪い組み合わせまで公開していきます。セットアップやトリガーの一部に移動平均線を使用している場合、どの組み合わせが優位性があるのかなど参考になるかもしれません。

検証方法は2本の移動平均線がゴールデンクロスで買い、デッドクロスで決済、デッドクロスで売り、ゴールデンクロスで決済するシンプルなロジックです。

スキャルピングやデイトレードで使用する短期足に、あなたが移動平均線を表示している場合、その移動平均線にどれだけ優位性があるのか知っておくのも重要です。移動平均線の傾きやローソク足と移動平均線の乖離、その他のテクニカル指標などフィルターを加えていくことでパフォーマンスを上げることも可能です。

USDJPY 4時間足のEMA組み合わせデータ(2015年1月~2019年11月)

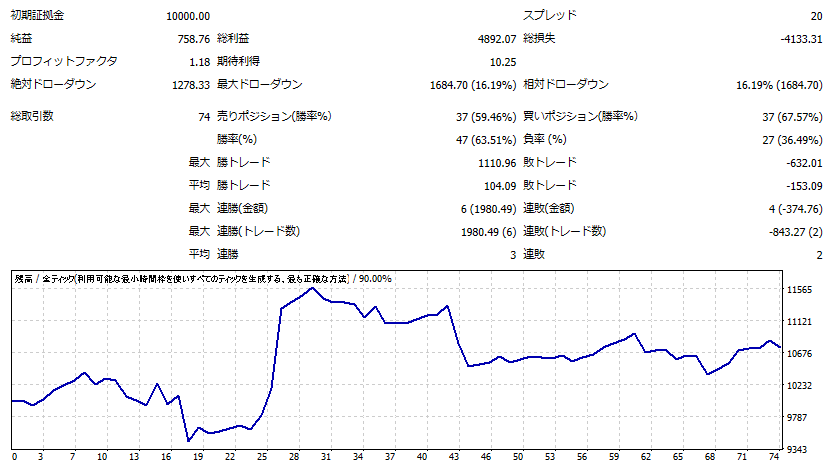

下表1番目の期間23と129の検証結果詳細

◆EMA期間20~25を中心に検証

プロフィットファクター上位から順番にしています。

| 期間a | 期間b | 損益 | PF | DD |

| ema23 | ema129 | 758.76 | 1.18 | 16.19% |

| ema21 | ema2 | 670.71 | 1.06 | 16.00% |

| ema20 | ema16 | 175.38 | 1.01 | 16.79% |

| ema21 | ema5 | 81.33 | 1.01 | 18.82% |

| ema20 | ema3 | -61.31 | 0.99 | 17.51% |

| ema20 | ema5 | -140.19 | 0.99 | 18.70% |

| ema20 | ema9 | -243.05 | 0.98 | 19.94% |

| ema25 | ema190 | -165.47 | 0.96 | 19.11% |

| ema20 | ema12 | -459.83 | 0.96 | 20.23% |

| ema23 | ema7 | -446.82 | 0.96 | 21.88% |

| ema24 | ema28 | -783.44 | 0.94 | 31.09% |

| ema21 | ema1 | -770.21 | 0.93 | 21.71% |

| ema20 | ema8 | -859.88 | 0.93 | 25.73% |

| ema20 | ema2 | -1062.37 | 0.91 | 20.71% |

| ema23 | ema21 | -1238.68 | 0.91 | 23.66% |

| ema20 | ema27 | -1169.8 | 0.9 | 24.35% |

| ema25 | ema2 | -1171.77 | 0.9 | 22.15% |

| ema22 | ema1 | -1257.35 | 0.89 | 23.81% |

| ema21 | ema115 | -598.61 | 0.89 | 23.37% |

| ema25 | ema200 | -536.49 | 0.88 | 19.95% |

| ema25 | ema33 | -1268.26 | 0.88 | 22.50% |

| ema21 | ema16 | -1604.83 | 0.88 | 26.78% |

| ema20 | ema4 | -1727.18 | 0.86 | 27.48% |

| ema20 | ema102 | -717.43 | 0.86 | 21.55% |

| ema24 | ema177 | -630.27 | 0.86 | 20.26% |

| ema24 | ema2 | -1599.46 | 0.86 | 22.87% |

| ema25 | ema177 | -716.78 | 0.84 | 18.30% |

| ema24 | ema134 | -796.7 | 0.84 | 19.54% |

| ema22 | ema15 | -2085.14 | 0.84 | 33.75% |

| ema23 | ema191 | -763.48 | 0.84 | 20.71% |

| ema24 | ema12 | -1907.73 | 0.83 | 26.77% |

| ema25 | ema34 | -1863.07 | 0.83 | 31.91% |

| ema22 | ema130 | -811.14 | 0.82 | 18.23% |

| ema24 | ema35 | -1844.91 | 0.82 | 29.62% |

| ema20 | ema1 | -2352.34 | 0.81 | 28.79% |

| ema22 | ema179 | -916.96 | 0.81 | 20.50% |

| ema20 | ema17 | -2962.09 | 0.81 | 35.94% |

| ema25 | ema50 | -1459.25 | 0.8 | 27.48% |

| ema21 | ema60 | -1429.02 | 0.8 | 30.08% |

| ema23 | ema193 | -989.38 | 0.8 | 21.02% |

| ema25 | ema57 | -1443.54 | 0.8 | 29.36% |

| ema20 | ema21 | -3177.5 | 0.8 | 35.61% |

| ema20 | ema196 | -956.22 | 0.79 | 23.34% |

| ema23 | ema197 | -994.03 | 0.79 | 22.41% |

| ema25 | ema134 | -1031.25 | 0.79 | 19.71% |

| ema20 | ema195 | -982.3 | 0.79 | 23.48% |

| ema20 | ema194 | -1047.94 | 0.78 | 23.52% |

| ema20 | ema72 | -1661.6 | 0.76 | 28.96% |

| ema25 | ema130 | -1163.89 | 0.76 | 20.24% |

| ema21 | ema53 | -1706.56 | 0.76 | 29.17% |

| ema21 | ema149 | -1173.09 | 0.76 | 20.19% |

| ema20 | ema193 | -1146.61 | 0.76 | 23.69% |

| ema20 | ema64 | -1662.04 | 0.76 | 30.30% |

| ema25 | ema69 | -1584.2 | 0.76 | 26.01% |

| ema21 | ema197 | -1177.83 | 0.75 | 22.79% |

| ema25 | ema102 | -1327.45 | 0.75 | 24.03% |

| ema23 | ema136 | -1178.81 | 0.75 | 22.41% |

| ema20 | ema48 | -1929.17 | 0.75 | 31.58% |

| ema20 | ema200 | -1214.89 | 0.75 | 22.18% |

| ema25 | ema111 | -1274.09 | 0.75 | 22.32% |

| ema20 | ema49 | -1941.9 | 0.75 | 29.61% |

| ema21 | ema130 | -1241.45 | 0.74 | 20.59% |

| ema24 | ema40 | -2311.74 | 0.74 | 34.30% |

| ema20 | ema25 | -3759.51 | 0.74 | 47.70% |

| ema24 | ema37 | -2603.18 | 0.74 | 38.00% |

| ema24 | ema57 | -1937.14 | 0.74 | 33.71% |

| ema25 | ema3 | -3251.48 | 0.73 | 35.03% |

| ema25 | ema137 | -1344.8 | 0.73 | 21.70% |

| ema25 | ema8 | -3352.09 | 0.73 | 38.00% |

| ema22 | ema87 | -1709.28 | 0.73 | 28.20% |

| ema24 | ema55 | -1983.12 | 0.73 | 33.24% |

| ema25 | ema97 | -1595.51 | 0.72 | 27.39% |

| ema24 | ema155 | -1383.68 | 0.72 | 23.44% |

| ema20 | ema70 | -1989.76 | 0.72 | 31.19% |

| ema21 | ema181 | -1375.86 | 0.72 | 25.96% |

| ema22 | ema150 | -1416.97 | 0.72 | 23.04% |

| ema20 | ema134 | -1432.78 | 0.72 | 24.08% |

| ema20 | ema47 | -2302.54 | 0.71 | 34.43% |

| ema20 | ema191 | -1415.32 | 0.71 | 23.72% |

| ema21 | ema66 | -2127.68 | 0.7 | 35.06% |

| ema23 | ema159 | -1558.95 | 0.7 | 24.37% |

| ema25 | ema89 | -1930.75 | 0.69 | 29.85% |

| ema21 | ema67 | -2177.2 | 0.69 | 34.20% |

| ema21 | ema158 | -1635.59 | 0.68 | 24.92% |

| ema21 | ema128 | -1644.68 | 0.67 | 23.80% |

| ema24 | ema63 | -2458.44 | 0.66 | 36.17% |

| ema20 | ema148 | -1716.17 | 0.66 | 23.63% |

| ema20 | ema32 | -3578.42 | 0.65 | 43.86% |

| ema24 | ema93 | -2214.47 | 0.65 | 30.19% |

| ema21 | ema90 | -2301.65 | 0.65 | 35.61% |

| ema20 | ema161 | -1844.22 | 0.64 | 25.94% |

| ema20 | ema132 | -1817.94 | 0.64 | 24.49% |

| ema21 | ema33 | -3678.69 | 0.64 | 43.48% |

| ema24 | ema97 | -2220.12 | 0.63 | 31.67% |

| ema20 | ema76 | -2749.44 | 0.62 | 37.74% |

| ema20 | ema177 | -1910.67 | 0.62 | 29.89% |

| ema21 | ema77 | -2740.3 | 0.62 | 36.19% |

| ema21 | ema80 | -2718.59 | 0.61 | 37.27% |

| ema21 | ema164 | -2053.12 | 0.61 | 27.46% |

| ema20 | ema173 | -2045.7 | 0.61 | 29.86% |

| ema23 | ema91 | -2692.99 | 0.59 | 34.60% |

| ema20 | ema81 | -2972.97 | 0.59 | 39.05% |

| ema22 | ema112 | -2374.03 | 0.59 | 30.51% |

| ema20 | ema130 | -2221.38 | 0.59 | 28.17% |

| ema21 | ema37 | -4009.2 | 0.59 | 44.53% |

| ema20 | ema129 | -2256.8 | 0.58 | 28.74% |

| ema20 | ema131 | -2335.08 | 0.57 | 28.91% |

| ema23 | ema108 | -2546.55 | 0.57 | 33.00% |

| ema23 | ema87 | -2950.17 | 0.56 | 35.58% |

| ema20 | ema136 | -2353.67 | 0.56 | 29.69% |

| ema20 | ema97 | -3060.75 | 0.55 | 38.32% |

| ema20 | ema123 | -2683.21 | 0.53 | 33.19% |

| ema20 | ema92 | -3293.17 | 0.52 | 40.38% |

| ema20 | ema113 | -3211.62 | 0.47 | 35.75% |

| ema20 | ema105 | -3683.22 | 0.44 | 40.84% |

◆EMA期間1~200まで幅広く検証

ドル円4時間足のEMA(指数平滑移動平均線)組み合わせでは、表2番目のEMA期間2と期間145でプロフィットファクター1.17(損益866ドル)となっています。

| 期間a | 期間b | 損益 | PF | DD |

| 45 | 169 | 633.68 | 1.17 | 15.54% |

| 2 | 145 | 866.07 | 1.17 | 14.65% |

| 91 | 55 | 733.49 | 1.15 | 9.83% |

| 138 | 19 | 688.95 | 1.15 | 15.57% |

| 2 | 100 | 697.5 | 1.12 | 15.43% |

| 2 | 97 | 673.96 | 1.11 | 15.66% |

| 161 | 173 | 447.88 | 1.1 | 19.92% |

| 34 | 16 | 797.3 | 1.09 | 11.46% |

| 150 | 131 | 386.27 | 1.09 | 16.98% |

| 122 | 167 | 284.11 | 1.07 | 18.70% |

| 119 | 167 | 194.66 | 1.05 | 23.55% |

| 114 | 22 | 231.75 | 1.04 | 14.57% |

| 182 | 199 | 170.15 | 1.04 | 21.96% |

| 2 | 137 | 217.32 | 1.04 | 14.23% |

| 130 | 107 | 171.24 | 1.04 | 14.78% |

| 164 | 175 | 167.03 | 1.04 | 16.82% |

| 194 | 167 | 135.51 | 1.03 | 20.02% |

| 194 | 193 | 112.95 | 1.03 | 23.47% |

| 178 | 179 | 101.67 | 1.02 | 24.27% |

| 94 | 112 | 84.97 | 1.01 | 22.30% |

| 83 | 25 | 56 | 1.01 | 11.63% |

| 5 | 145 | 49.32 | 1.01 | 22.03% |

| 115 | 4 | 44.82 | 1.01 | 15.38% |

| 114 | 34 | -23.94 | 1 | 14.52% |

| 119 | 144 | -22.89 | 1 | 26.29% |

| 180 | 162 | -46.32 | 0.99 | 26.36% |

| 2 | 193 | -134.45 | 0.97 | 21.35% |

| 2 | 81 | -198.46 | 0.97 | 23.28% |

| 184 | 182 | -135.08 | 0.97 | 26.28% |

| 123 | 79 | -140.09 | 0.97 | 16.80% |

| 138 | 111 | -194.17 | 0.96 | 18.37% |

| 2 | 192 | -257.56 | 0.95 | 21.93% |

| 107 | 32 | -285.95 | 0.95 | 14.38% |

| 7 | 190 | -304.7 | 0.94 | 20.30% |

| 130 | 195 | -239.69 | 0.94 | 24.32% |

| 2 | 183 | -337.45 | 0.93 | 26.41% |

| 2 | 164 | -387.47 | 0.93 | 25.78% |

| 5 | 2 | -1706.52 | 0.93 | 23.24% |

| 130 | 96 | -346.64 | 0.92 | 16.99% |

| 4 | 1 | -2033.52 | 0.92 | 30.45% |

| 2 | 90 | -631.22 | 0.91 | 21.14% |

| 114 | 193 | -392.79 | 0.9 | 27.38% |

| 2 | 85 | -743.47 | 0.9 | 26.50% |

| 2 | 177 | -547.66 | 0.9 | 30.38% |

| 2 | 132 | -623.48 | 0.89 | 22.78% |

| 200 | 104 | -455.78 | 0.89 | 22.11% |

| 150 | 196 | -501.53 | 0.89 | 23.62% |

| 165 | 190 | -511.03 | 0.89 | 24.91% |

| 190 | 126 | -506.43 | 0.89 | 21.64% |

| 2 | 129 | -715.63 | 0.88 | 24.79% |

| 125 | 143 | -539.9 | 0.88 | 25.15% |

| 79 | 89 | -886.34 | 0.88 | 21.79% |

| 65 | 43 | -874.63 | 0.88 | 13.89% |

| 194 | 60 | -513.39 | 0.87 | 21.96% |

| 145 | 40 | -637.2 | 0.87 | 21.64% |

| 2 | 197 | -679.99 | 0.87 | 22.33% |

| 4 | 126 | -860.83 | 0.87 | 19.92% |

| 172 | 172 | -619.22 | 0.87 | 20.15% |

| 50 | 186 | -598.38 | 0.86 | 24.00% |

| 8 | 186 | -777.24 | 0.86 | 23.28% |

| 114 | 129 | -675.52 | 0.86 | 23.09% |

| 195 | 81 | -626.43 | 0.86 | 20.84% |

| 22 | 20 | -2071.26 | 0.85 | 32.05% |

| 194 | 196 | -740.3 | 0.85 | 25.62% |

| 2 | 200 | -773.84 | 0.85 | 23.11% |

| 79 | 82 | -1236.74 | 0.85 | 25.62% |

| 150 | 176 | -713.23 | 0.85 | 26.68% |

| 79 | 111 | -760.38 | 0.85 | 21.02% |

| 178 | 155 | -775.21 | 0.84 | 24.78% |

| 162 | 187 | -735.41 | 0.84 | 25.33% |

| 2 | 17 | -2031.61 | 0.84 | 25.92% |

| 28 | 59 | -1006.46 | 0.84 | 20.50% |

| 34 | 151 | -700.87 | 0.84 | 19.80% |

| 48 | 30 | -1505.25 | 0.83 | 18.83% |

| 2 | 8 | -3001.59 | 0.83 | 39.05% |

| 132 | 51 | -839.58 | 0.83 | 18.56% |

| 194 | 169 | -821.28 | 0.83 | 23.50% |

| 164 | 120 | -974.83 | 0.82 | 23.74% |

| 2 | 16 | -2472.95 | 0.82 | 29.48% |

| 15 | 189 | -914.13 | 0.82 | 19.01% |

| 194 | 107 | -886.72 | 0.81 | 22.08% |

| 2 | 104 | -1357.61 | 0.8 | 26.14% |

| 195 | 77 | -886.41 | 0.8 | 21.52% |

| 37 | 200 | -827.58 | 0.8 | 22.43% |

| 37 | 134 | -914.04 | 0.8 | 21.15% |

| 130 | 60 | -1068.88 | 0.79 | 22.40% |

| 79 | 62 | -1480.2 | 0.79 | 21.05% |

| 79 | 149 | -971.34 | 0.78 | 20.28% |

| 2 | 65 | -1771.18 | 0.78 | 36.17% |

| 8 | 105 | -1485.34 | 0.78 | 28.72% |

| 12 | 1 | -3580.97 | 0.78 | 40.46% |

| 9 | 1 | -4142.45 | 0.78 | 46.06% |

| 114 | 197 | -918.12 | 0.78 | 29.43% |

| 104 | 200 | -1074.62 | 0.78 | 26.85% |

| 2 | 107 | -1533.97 | 0.78 | 26.72% |

| 32 | 109 | -1167.59 | 0.77 | 23.15% |

| 2 | 25 | -2710.55 | 0.77 | 35.11% |

| 178 | 131 | -1234.07 | 0.76 | 22.35% |

| 74 | 175 | -1074.16 | 0.76 | 24.08% |

| 45 | 39 | -2488.79 | 0.76 | 36.04% |

| 2 | 1 | -9991.93 | 0.75 | 99.92% |

| 146 | 105 | -1320.48 | 0.75 | 22.28% |

| 68 | 17 | -2043.39 | 0.75 | 26.83% |

| 2 | 44 | -2527.62 | 0.74 | 38.43% |

| 198 | 127 | -1248.87 | 0.74 | 19.93% |

| 2 | 64 | -2187.32 | 0.74 | 35.87% |

| 114 | 178 | -1256.89 | 0.73 | 28.40% |

| 21 | 68 | -1898.02 | 0.73 | 32.80% |

| 24 | 50 | -2171.93 | 0.71 | 32.32% |

| 22 | 176 | -1455.36 | 0.71 | 24.51% |

| 194 | 11 | -1537.23 | 0.7 | 26.90% |

| 2 | 113 | -2133.13 | 0.7 | 31.38% |

| 10 | 1 | -5882.81 | 0.7 | 59.49% |

| 121 | 23 | -1970.11 | 0.69 | 26.00% |

| 182 | 133 | -1659.13 | 0.68 | 25.47% |

| 3 | 112 | -2438.69 | 0.68 | 32.77% |

| 2 | 32 | -3656.46 | 0.68 | 42.38% |

| 82 | 173 | -1386.25 | 0.68 | 25.47% |

| 89 | 184 | -1452.97 | 0.66 | 26.09% |

| 74 | 194 | -1520.79 | 0.66 | 24.49% |

| 68 | 175 | -1544.67 | 0.66 | 24.64% |

| 74 | 199 | -1522.68 | 0.65 | 24.69% |

| 18 | 173 | -1758.63 | 0.65 | 25.32% |

| 2 | 48 | -3364.16 | 0.64 | 41.95% |

| 94 | 83 | -2540.32 | 0.64 | 32.51% |

| 170 | 96 | -2163.68 | 0.59 | 35.31% |

| 158 | 28 | -2833.01 | 0.55 | 35.95% |

| 17 | 133 | -2731.88 | 0.54 | 34.66% |

USDJPY 1時間足のEMA組み合わせデータ(2015年1月~2019年11月)

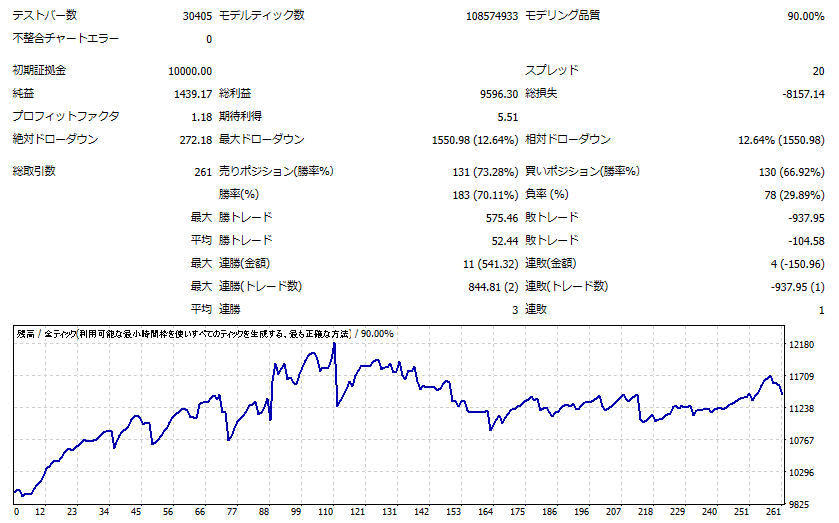

下表1番目の期間23と184の検証結果詳細

◆EMA期間20~25を中心に検証

| 期間a | 期間b | 損益 | PF | DD |

| ema23 | ema184 | 1439.17 | 1.18 | 12.64% |

| ema20 | ema195 | 1316.57 | 1.16 | 13.82% |

| ema24 | ema188 | 1326.69 | 1.16 | 11.37% |

| ema23 | ema185 | 1125.31 | 1.14 | 12.13% |

| ema21 | ema196 | 987.61 | 1.12 | 13.17% |

| ema21 | ema193 | 942.94 | 1.12 | 14.02% |

| ema21 | ema195 | 966.57 | 1.12 | 13.52% |

| ema20 | ema193 | 940.97 | 1.12 | 14.23% |

| ema23 | ema187 | 742.47 | 1.09 | 12.60% |

| ema20 | ema181 | 479.52 | 1.05 | 14.97% |

| ema23 | ema162 | 198.89 | 1.02 | 15.55% |

| ema20 | ema177 | 192.57 | 1.02 | 15.38% |

| ema22 | ema147 | 171.05 | 1.02 | 16.66% |

| ema24 | ema17 | 10.2 | 1 | 13.50% |

| ema22 | ema34 | -24.42 | 1 | 19.01% |

| ema20 | ema25 | -58.95 | 1 | 20.65% |

| ema21 | ema8 | -237.82 | 0.99 | 18.09% |

| ema25 | ema24 | -362.55 | 0.98 | 16.91% |

| ema23 | ema37 | -607.57 | 0.96 | 20.00% |

| ema24 | ema24 | -994.49 | 0.96 | 18.26% |

| ema20 | ema153 | -405.09 | 0.96 | 15.71% |

| ema20 | ema26 | -1024.82 | 0.96 | 26.84% |

| ema25 | ema17 | -996.8 | 0.96 | 16.74% |

| ema23 | ema16 | -1179.25 | 0.95 | 19.79% |

| ema23 | ema120 | -540.52 | 0.95 | 19.22% |

| ema25 | ema2 | -1272.51 | 0.94 | 19.45% |

| ema20 | ema8 | -1370.44 | 0.94 | 21.02% |

| ema23 | ema133 | -600.6 | 0.94 | 17.71% |

| ema23 | ema152 | -587.96 | 0.94 | 18.15% |

| ema20 | ema151 | -626.89 | 0.93 | 19.79% |

| ema24 | ema49 | -978.41 | 0.93 | 22.35% |

| ema21 | ema161 | -640.81 | 0.93 | 18.46% |

| ema23 | ema12 | -1590.7 | 0.93 | 18.76% |

| ema22 | ema97 | -838.23 | 0.92 | 19.66% |

| ema23 | ema38 | -1329.61 | 0.92 | 26.80% |

| ema24 | ema97 | -882.37 | 0.92 | 22.34% |

| ema20 | ema13 | -2126.62 | 0.91 | 21.90% |

| ema20 | ema11 | -2110.21 | 0.91 | 26.23% |

| ema20 | ema152 | -881.3 | 0.91 | 19.77% |

| ema24 | ema111 | -984.71 | 0.91 | 21.42% |

| ema21 | ema164 | -886.54 | 0.91 | 20.04% |

| ema25 | ema96 | -1032.94 | 0.91 | 23.99% |

| ema25 | ema115 | -958.33 | 0.9 | 20.42% |

| ema20 | ema17 | -2744.38 | 0.9 | 29.10% |

| ema20 | ema3 | -2614.5 | 0.9 | 31.33% |

| ema25 | ema45 | -1555.21 | 0.9 | 27.99% |

| ema20 | ema126 | -1082.68 | 0.89 | 20.55% |

| ema25 | ema107 | -1122.33 | 0.89 | 23.07% |

| ema25 | ema129 | -1053.04 | 0.89 | 19.67% |

| ema23 | ema130 | -1051.63 | 0.89 | 18.92% |

| ema21 | ema129 | -1088.08 | 0.89 | 22.23% |

| ema20 | ema2 | -2875.28 | 0.89 | 32.36% |

| ema20 | ema16 | -3158.6 | 0.89 | 33.24% |

| ema23 | ema52 | -1618.84 | 0.88 | 30.36% |

| ema20 | ema68 | -1574.36 | 0.88 | 28.82% |

| ema24 | ema129 | -1213.46 | 0.88 | 18.83% |

| ema20 | ema67 | -1602.24 | 0.88 | 28.76% |

| ema24 | ema2 | -2915.96 | 0.87 | 29.75% |

| ema23 | ema54 | -1792.99 | 0.87 | 29.93% |

| ema25 | ema97 | -1458.53 | 0.87 | 26.23% |

| ema21 | ema136 | -1312.02 | 0.87 | 23.70% |

| ema20 | ema104 | -1498.41 | 0.87 | 23.58% |

| ema21 | ema102 | -1465.35 | 0.87 | 25.21% |

| ema20 | ema33 | -2443.95 | 0.86 | 31.76% |

| ema20 | ema110 | -1525.61 | 0.86 | 27.57% |

| ema25 | ema8 | -3164.01 | 0.86 | 33.75% |

| ema25 | ema49 | -2030.5 | 0.86 | 30.96% |

| ema20 | ema49 | -2037.18 | 0.86 | 29.18% |

| ema20 | ema139 | -1433.85 | 0.85 | 23.91% |

| ema20 | ema65 | -1989.24 | 0.85 | 29.60% |

| ema20 | ema5 | -3761.28 | 0.85 | 38.20% |

| ema22 | ema98 | -1671.37 | 0.85 | 28.02% |

| ema20 | ema129 | -1586.91 | 0.85 | 25.29% |

| ema20 | ema114 | -1736.49 | 0.84 | 26.80% |

| ema20 | ema113 | -1759.44 | 0.84 | 26.96% |

| ema20 | ema6 | -4095.08 | 0.84 | 41.87% |

| ema20 | ema116 | -1749.33 | 0.84 | 26.79% |

| ema20 | ema40 | -2581.99 | 0.84 | 33.72% |

| ema20 | ema132 | -1715.86 | 0.83 | 26.68% |

| ema20 | ema38 | -2744.93 | 0.83 | 35.75% |

| ema25 | ema81 | -2119.52 | 0.83 | 30.10% |

| ema24 | ema71 | -2280.58 | 0.82 | 33.17% |

| ema20 | ema64 | -2489.44 | 0.82 | 33.52% |

| ema20 | ema134 | -1862.94 | 0.82 | 27.66% |

| ema25 | ema48 | -2729.69 | 0.82 | 37.80% |

| ema20 | ema41 | -2937.69 | 0.82 | 37.52% |

| ema24 | ema62 | -2603.85 | 0.81 | 34.20% |

| ema21 | ema63 | -2658.95 | 0.8 | 35.02% |

| ema21 | ema41 | -3233.51 | 0.8 | 42.11% |

| ema23 | ema71 | -2652.44 | 0.8 | 36.41% |

| ema21 | ema52 | -3007.82 | 0.8 | 39.45% |

| ema23 | ema83 | -2530.05 | 0.79 | 33.88% |

| ema20 | ema81 | -2689.44 | 0.79 | 36.33% |

| ema20 | ema80 | -2802.99 | 0.78 | 36.71% |

| ema25 | ema1 | -5306.87 | 0.78 | 53.54% |

| ema21 | ema91 | -2732.91 | 0.77 | 36.81% |

| ema23 | ema67 | -3184.52 | 0.77 | 41.72% |

| ema21 | ema88 | -3305.15 | 0.74 | 39.11% |

| ema20 | ema1 | -7129.13 | 0.74 | 72.50% |

◆EMA期間1~200まで幅広く検証

表2番目の期間80と期間33でプロフィットファクター1.11、損益1274となっています。

| 期間a | 期間b | 損益 | PF | DD |

| 111 | 91 | 1207.88 | 1.12 | 16.09% |

| 80 | 33 | 1274.99 | 1.11 | 10.61% |

| 102 | 58 | 1018.08 | 1.1 | 16.97% |

| 99 | 123 | 973.77 | 1.1 | 16.40% |

| 130 | 62 | 825.3 | 1.1 | 10.27% |

| 115 | 64 | 656.43 | 1.07 | 19.06% |

| 114 | 129 | 730.52 | 1.07 | 19.76% |

| 106 | 39 | 575.73 | 1.06 | 15.72% |

| 28 | 197 | 462.6 | 1.06 | 16.65% |

| 13 | 193 | 433.41 | 1.05 | 16.63% |

| 111 | 105 | 193.97 | 1.02 | 18.28% |

| 133 | 131 | 83.82 | 1.01 | 19.76% |

| 129 | 77 | 16.04 | 1 | 15.55% |

| 109 | 149 | -11.36 | 1 | 20.02% |

| 145 | 163 | -122.6 | 0.99 | 21.84% |

| 82 | 90 | -169.32 | 0.99 | 23.30% |

| 24 | 155 | -141.69 | 0.98 | 15.81% |

| 88 | 81 | -259 | 0.98 | 19.89% |

| 57 | 93 | -249.34 | 0.98 | 25.61% |

| 107 | 73 | -375.27 | 0.96 | 25.38% |

| 130 | 75 | -339.34 | 0.96 | 15.96% |

| 114 | 152 | -387.57 | 0.96 | 22.92% |

| 33 | 77 | -435.28 | 0.96 | 16.17% |

| 130 | 161 | -492.35 | 0.95 | 22.46% |

| 15 | 77 | -669.22 | 0.95 | 22.07% |

| 137 | 172 | -534.72 | 0.95 | 22.34% |

| 125 | 135 | -634.76 | 0.94 | 21.04% |

| 130 | 103 | -582.83 | 0.94 | 21.46% |

| 133 | 134 | -655.66 | 0.94 | 25.66% |

| 133 | 200 | -418.4 | 0.94 | 19.02% |

| 50 | 129 | -615.4 | 0.93 | 23.10% |

| 133 | 157 | -765.06 | 0.93 | 24.22% |

| 130 | 170 | -736.71 | 0.92 | 21.63% |

| 130 | 172 | -765.23 | 0.91 | 21.56% |

| 114 | 196 | -603.7 | 0.91 | 19.92% |

| 55 | 106 | -940.53 | 0.9 | 29.29% |

| 154 | 121 | -940.28 | 0.9 | 19.77% |

| 13 | 75 | -1417.7 | 0.9 | 26.90% |

| 25 | 129 | -1053.04 | 0.89 | 19.67% |

| 29 | 121 | -1091.84 | 0.89 | 18.99% |

| 63 | 194 | -839.26 | 0.89 | 21.06% |

| 162 | 171 | -1247.31 | 0.89 | 19.65% |

| 126 | 141 | -1321.74 | 0.88 | 26.17% |

| 60 | 114 | -1103.2 | 0.88 | 28.67% |

| 63 | 189 | -916.84 | 0.88 | 21.36% |

| 68 | 46 | -1732.4 | 0.88 | 22.71% |

| 12 | 20 | -2823.4 | 0.87 | 36.21% |

| 109 | 194 | -864.65 | 0.87 | 20.74% |

| 17 | 129 | -1360.68 | 0.87 | 23.87% |

| 194 | 103 | -1076.73 | 0.87 | 15.31% |

| 85 | 12 | -1772.89 | 0.87 | 22.86% |

| 114 | 193 | -905.48 | 0.87 | 21.32% |

| 178 | 171 | -1383.18 | 0.86 | 24.76% |

| 144 | 110 | -1395.77 | 0.86 | 21.09% |

| 174 | 125 | -1393.45 | 0.86 | 23.88% |

| 172 | 123 | -1422.19 | 0.86 | 20.96% |

| 14 | 128 | -1607.63 | 0.85 | 28.64% |

| 189 | 171 | -1492.17 | 0.84 | 23.54% |

| 199 | 68 | -1385.87 | 0.84 | 16.73% |

| 50 | 37 | -2940.5 | 0.83 | 31.32% |

| 194 | 75 | -1462.17 | 0.83 | 17.58% |

| 194 | 172 | -1643.99 | 0.83 | 23.54% |

| 50 | 193 | -1402.74 | 0.83 | 25.20% |

| 166 | 33 | -1836.16 | 0.82 | 23.49% |

| 37 | 197 | -1468.84 | 0.82 | 27.96% |

| 67 | 136 | -1575.09 | 0.82 | 28.71% |

| 194 | 161 | -1714.5 | 0.82 | 24.37% |

| 178 | 189 | -1933.6 | 0.82 | 23.88% |

| 179 | 18 | -1998.28 | 0.81 | 25.12% |

| 194 | 116 | -1671.8 | 0.81 | 20.42% |

| 178 | 104 | -1856.36 | 0.8 | 22.22% |

| 194 | 170 | -1920.48 | 0.8 | 25.12% |

| 170 | 110 | -1999.47 | 0.8 | 21.92% |

| 194 | 200 | -2125.57 | 0.8 | 27.64% |

| 140 | 1 | -2246.52 | 0.79 | 29.54% |

| 2 | 55 | -3510.2 | 0.79 | 37.75% |

| 156 | 68 | -2237.46 | 0.78 | 23.88% |

| 198 | 172 | -2157.22 | 0.78 | 28.09% |

| 2 | 65 | -3435.25 | 0.78 | 40.97% |

| 200 | 171 | -2262.67 | 0.77 | 29.25% |

| 16 | 86 | -2977.69 | 0.77 | 36.75% |

| 190 | 57 | -2206.66 | 0.77 | 27.45% |

| 8 | 170 | -2689.68 | 0.76 | 36.73% |

| 178 | 69 | -2336.71 | 0.76 | 24.66% |

| 87 | 140 | -2402.71 | 0.75 | 38.29% |

| 17 | 78 | -3335.05 | 0.75 | 40.88% |

| 68 | 95 | -3366.92 | 0.75 | 42.60% |

| 159 | 59 | -2683.54 | 0.75 | 29.46% |

| 73 | 121 | -2472.38 | 0.75 | 32.90% |

| 193 | 28 | -2647.18 | 0.75 | 30.28% |

| 50 | 1 | -4537.47 | 0.75 | 48.80% |

| 17 | 1 | -7601.06 | 0.73 | 76.62% |

| 192 | 129 | -2609.36 | 0.73 | 28.01% |

| 2 | 1 | -9998.21 | 0.73 | 99.98% |

| 179 | 89 | -2754.96 | 0.73 | 30.17% |

| 2 | 7 | -9998.05 | 0.72 | 99.98% |

| 184 | 76 | -2706.01 | 0.72 | 28.51% |

| 5 | 133 | -3350.74 | 0.72 | 39.66% |

| 2 | 10 | -9604 | 0.71 | 96.63% |

| 6 | 1 | -9998.02 | 0.71 | 99.98% |

| 162 | 66 | -3170.38 | 0.71 | 33.17% |

| 2 | 89 | -4103.61 | 0.7 | 46.51% |

| 74 | 163 | -2529.5 | 0.7 | 35.90% |

| 3 | 1 | -9998.08 | 0.7 | 99.98% |

| 2 | 94 | -4224.28 | 0.69 | 45.97% |

USDJPY 15分足のEMA組み合わせデータ(2015年1月~2019年11月)

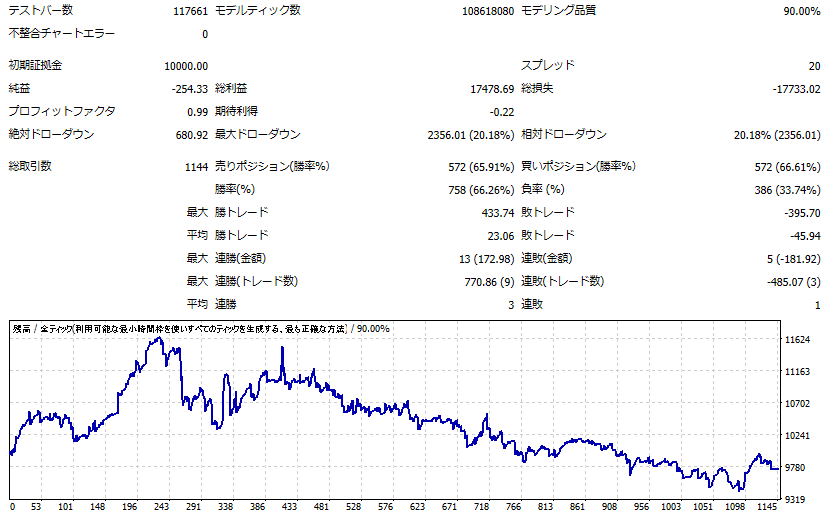

下表の一番目の期間25、期間146のバックテスト詳細

◆EMA期間20~25を中心に検証

| 期間a | 期間b | 損益 | PF | DD |

| ema25 | ema146 | -254.33 | 0.99 | 20.18% |

| ema25 | ema151 | -664.66 | 0.96 | 23.02% |

| ema21 | ema200 | -654.3 | 0.96 | 21.57% |

| ema23 | ema193 | -945.8 | 0.94 | 23.68% |

| ema25 | ema155 | -1072.8 | 0.94 | 22.33% |

| ema24 | ema192 | -1025.57 | 0.94 | 25.31% |

| ema24 | ema179 | -1103.98 | 0.94 | 20.52% |

| ema22 | ema170 | -1193.02 | 0.93 | 21.60% |

| ema22 | ema190 | -1155.07 | 0.93 | 23.71% |

| ema20 | ema161 | -1238.45 | 0.93 | 23.97% |

| ema23 | ema198 | -1181.07 | 0.93 | 26.11% |

| ema21 | ema192 | -1242.69 | 0.93 | 26.39% |

| ema22 | ema200 | -1270.43 | 0.93 | 23.76% |

| ema25 | ema185 | -1282.55 | 0.92 | 28.12% |

| ema21 | ema164 | -1635.63 | 0.91 | 25.33% |

| ema24 | ema148 | -1691.67 | 0.91 | 25.35% |

| ema24 | ema172 | -1668.96 | 0.91 | 24.54% |

| ema24 | ema123 | -1829.79 | 0.91 | 30.01% |

| ema24 | ema124 | -1902.87 | 0.9 | 31.88% |

| ema24 | ema147 | -1839.61 | 0.9 | 26.67% |

| ema22 | ema199 | -1770.85 | 0.9 | 26.81% |

| ema20 | ema197 | -1934.52 | 0.89 | 28.42% |

| ema20 | ema195 | -1944.37 | 0.89 | 28.45% |

| ema24 | ema193 | -1928.07 | 0.89 | 28.58% |

| ema25 | ema160 | -2092.58 | 0.88 | 29.10% |

| ema24 | ema142 | -2208.33 | 0.88 | 30.33% |

| ema20 | ema89 | -2596.11 | 0.88 | 37.63% |

| ema23 | ema170 | -2124.42 | 0.88 | 28.15% |

| ema23 | ema121 | -2344.77 | 0.88 | 33.96% |

| ema20 | ema193 | -2054.25 | 0.88 | 29.77% |

| ema20 | ema88 | -2613.54 | 0.88 | 36.45% |

| ema25 | ema97 | -2536.79 | 0.88 | 35.84% |

| ema20 | ema97 | -2687.22 | 0.88 | 39.13% |

| ema21 | ema82 | -2822.4 | 0.87 | 40.39% |

| ema25 | ema92 | -2847.82 | 0.87 | 38.91% |

| ema20 | ema186 | -2347.54 | 0.87 | 32.20% |

| ema22 | ema57 | -3358.68 | 0.87 | 44.12% |

| ema24 | ema104 | -2815.01 | 0.87 | 39.60% |

| ema25 | ema88 | -3001.86 | 0.87 | 39.64% |

| ema20 | ema113 | -2861.27 | 0.86 | 36.07% |

| ema20 | ema200 | -2422.34 | 0.86 | 33.19% |

| ema24 | ema65 | -3373.87 | 0.86 | 43.05% |

| ema24 | ema107 | -2866.28 | 0.86 | 40.39% |

| ema22 | ema59 | -3513.26 | 0.86 | 46.36% |

| ema25 | ema175 | -2490.47 | 0.86 | 32.20% |

| ema25 | ema66 | -3384.08 | 0.86 | 42.97% |

| ema25 | ema124 | -2822.28 | 0.86 | 40.71% |

| ema25 | ema167 | -2584.12 | 0.86 | 32.82% |

| ema22 | ema122 | -2943.85 | 0.86 | 41.40% |

| ema25 | ema65 | -3509.4 | 0.86 | 44.02% |

| ema24 | ema103 | -3055.27 | 0.86 | 39.71% |

| ema25 | ema114 | -2944.87 | 0.86 | 39.10% |

| ema20 | ema177 | -2660.93 | 0.85 | 34.49% |

| ema25 | ema121 | -2984.68 | 0.85 | 42.84% |

| ema22 | ema107 | -3135.71 | 0.85 | 41.74% |

| ema21 | ema131 | -3009.38 | 0.85 | 40.17% |

| ema25 | ema104 | -3123.85 | 0.85 | 40.25% |

| ema25 | ema50 | -4046.18 | 0.85 | 50.36% |

| ema23 | ema51 | -3995.56 | 0.85 | 48.65% |

| ema24 | ema51 | -4068.9 | 0.85 | 48.97% |

| ema20 | ema167 | -2865.69 | 0.85 | 36.27% |

| ema21 | ema54 | -4050.96 | 0.85 | 49.72% |

| ema25 | ema48 | -4418.58 | 0.84 | 53.69% |

| ema20 | ema81 | -3656.15 | 0.84 | 47.36% |

| ema20 | ema49 | -4343.96 | 0.84 | 51.99% |

| ema21 | ema70 | -3836.02 | 0.84 | 48.02% |

| ema23 | ema61 | -4023.84 | 0.84 | 51.48% |

| ema20 | ema104 | -3472 | 0.84 | 45.63% |

| ema20 | ema136 | -3198.36 | 0.84 | 40.13% |

| ema25 | ema41 | -5167.19 | 0.84 | 60.89% |

| ema20 | ema129 | -3359.46 | 0.84 | 43.04% |

| ema21 | ema110 | -3479.21 | 0.84 | 43.61% |

| ema20 | ema152 | -3175.78 | 0.84 | 39.68% |

| ema25 | ema38 | -5823.73 | 0.84 | 65.96% |

| ema20 | ema33 | -5877.3 | 0.84 | 66.21% |

| ema20 | ema145 | -3262.92 | 0.83 | 37.96% |

| ema20 | ema134 | -3403.82 | 0.83 | 42.69% |

| ema22 | ema105 | -3654.74 | 0.83 | 46.48% |

| ema20 | ema132 | -3511.09 | 0.83 | 43.07% |

| ema21 | ema32 | -7047.96 | 0.82 | 75.79% |

| ema20 | ema32 | -6814.69 | 0.82 | 74.93% |

| ema21 | ema103 | -4057.96 | 0.82 | 48.68% |

| ema20 | ema48 | -5214.62 | 0.81 | 61.21% |

| ema23 | ema33 | -7487.95 | 0.81 | 80.24% |

| ema20 | ema24 | -9994.7 | 0.81 | 99.96% |

| ema20 | ema124 | -4107.86 | 0.81 | 48.25% |

| ema20 | ema16 | -9998.15 | 0.8 | 99.98% |

| ema20 | ema65 | -5281.97 | 0.8 | 59.27% |

| ema22 | ema26 | -9990.97 | 0.79 | 99.96% |

| ema25 | ema22 | -9998.01 | 0.79 | 99.98% |

| ema20 | ema13 | -9998.08 | 0.79 | 99.98% |

| ema20 | ema12 | -9998.16 | 0.79 | 99.98% |

| ema24 | ema19 | -9998.07 | 0.78 | 99.98% |

| ema20 | ema17 | -9991.81 | 0.78 | 99.95% |

| ema20 | ema9 | -9990.57 | 0.78 | 99.92% |

| ema20 | ema8 | -9998.03 | 0.76 | 99.98% |

| ema23 | ema4 | -9998.02 | 0.76 | 99.98% |

| ema21 | ema9 | -9991.94 | 0.75 | 99.96% |

| ema20 | ema4 | -9998.02 | 0.74 | 99.98% |

| ema20 | ema5 | -9997.51 | 0.74 | 99.98% |

| ema20 | ema6 | -9990.92 | 0.73 | 99.91% |

| ema20 | ema3 | -9991.22 | 0.7 | 99.92% |

| ema21 | ema2 | -9991.43 | 0.69 | 99.95% |

| ema20 | ema2 | -9998.04 | 0.69 | 99.98% |

| ema20 | ema1 | -9998.11 | 0.63 | 99.98% |

◆EMA期間1~200まで幅広く検証

ほとんどの組み合わせでマイナス損益という結果になっています。下の表がバックテスト最適化結果です。 15分足になってくるとEMA2本のゴールデンクロスとデッドクロスはかなり厳しい結果になりました。

| 期間a | 期間b | 損益 | PF | DD |

| 81 | 94 | -112.91 | 1 | 17.87% |

| 89 | 145 | -138.71 | 0.99 | 21.31% |

| 94 | 87 | -361.5 | 0.99 | 17.27% |

| 58 | 14 | -1298.83 | 0.96 | 30.22% |

| 133 | 148 | -937.11 | 0.95 | 18.21% |

| 72 | 94 | -1196.38 | 0.95 | 27.23% |

| 114 | 134 | -1219.07 | 0.94 | 19.93% |

| 66 | 18 | -1682.05 | 0.94 | 21.10% |

| 77 | 90 | -1865.36 | 0.93 | 28.15% |

| 61 | 80 | -1900.66 | 0.93 | 25.87% |

| 110 | 33 | -1648.52 | 0.92 | 18.83% |

| 70 | 34 | -2038.04 | 0.92 | 21.98% |

| 113 | 39 | -1877.65 | 0.91 | 23.76% |

| 130 | 133 | -2004.88 | 0.91 | 23.09% |

| 171 | 51 | -1629.76 | 0.91 | 18.99% |

| 133 | 120 | -2079.42 | 0.9 | 23.46% |

| 50 | 63 | -2903.12 | 0.9 | 35.91% |

| 130 | 77 | -1965.15 | 0.9 | 29.06% |

| 166 | 193 | -2041.16 | 0.9 | 23.86% |

| 194 | 80 | -1713.6 | 0.9 | 26.76% |

| 116 | 67 | -2170.1 | 0.9 | 24.23% |

| 56 | 76 | -2815.35 | 0.89 | 35.18% |

| 35 | 123 | -1970.58 | 0.89 | 26.90% |

| 97 | 136 | -2056.07 | 0.89 | 29.14% |

| 130 | 131 | -2381.93 | 0.89 | 28.00% |

| 118 | 183 | -1696 | 0.89 | 26.14% |

| 130 | 47 | -2175.94 | 0.89 | 24.78% |

| 194 | 77 | -1806.72 | 0.89 | 26.47% |

| 155 | 74 | -1956.66 | 0.89 | 22.49% |

| 122 | 115 | -2552.88 | 0.89 | 28.26% |

| 152 | 185 | -2333.48 | 0.89 | 27.08% |

| 168 | 83 | -2028.21 | 0.89 | 22.87% |

| 50 | 95 | -2196.02 | 0.89 | 28.27% |

| 114 | 112 | -2699.41 | 0.89 | 29.29% |

| 96 | 152 | -1887.19 | 0.89 | 27.79% |

| 171 | 105 | -2068.17 | 0.89 | 26.25% |

| 148 | 135 | -2435.95 | 0.89 | 29.39% |

| 193 | 27 | -2029.18 | 0.88 | 24.48% |

| 49 | 67 | -3307.96 | 0.88 | 38.71% |

| 161 | 152 | -2434.18 | 0.88 | 27.63% |

| 109 | 26 | -2656.71 | 0.88 | 28.86% |

| 140 | 85 | -2292.39 | 0.88 | 29.39% |

| 17 | 164 | -2266.68 | 0.88 | 30.42% |

| 123 | 108 | -2814.36 | 0.88 | 30.88% |

| 57 | 135 | -1990.43 | 0.88 | 30.64% |

| 141 | 32 | -2437.75 | 0.88 | 26.65% |

| 46 | 81 | -2575.12 | 0.88 | 31.41% |

| 179 | 58 | -2114.1 | 0.88 | 26.77% |

| 140 | 30 | -2527.33 | 0.88 | 27.30% |

| 200 | 170 | -2258.37 | 0.88 | 28.13% |

| 134 | 170 | -2494.31 | 0.88 | 28.48% |

| 63 | 109 | -2322.67 | 0.87 | 33.81% |

| 50 | 185 | -1973.44 | 0.87 | 32.41% |

| 127 | 92 | -2632.74 | 0.87 | 29.14% |

| 165 | 83 | -2287.86 | 0.87 | 26.79% |

| 196 | 120 | -2167.78 | 0.87 | 27.29% |

| 75 | 18 | -3449.6 | 0.87 | 36.16% |

| 114 | 171 | -2237.54 | 0.87 | 29.33% |

| 44 | 45 | -5014.09 | 0.87 | 50.34% |

| 15 | 176 | -2473.49 | 0.87 | 33.67% |

| 107 | 65 | -3113.12 | 0.86 | 33.23% |

| 194 | 131 | -2459.79 | 0.86 | 30.70% |

| 107 | 172 | -2314.75 | 0.86 | 30.72% |

| 88 | 190 | -2134.16 | 0.86 | 32.41% |

| 128 | 82 | -2895.62 | 0.86 | 31.73% |

| 124 | 108 | -3299.72 | 0.86 | 35.75% |

| 133 | 188 | -2424.73 | 0.86 | 26.78% |

| 194 | 188 | -2728.92 | 0.86 | 31.86% |

| 130 | 188 | -2331.23 | 0.86 | 25.71% |

| 42 | 31 | -5352.43 | 0.86 | 56.12% |

| 176 | 47 | -2597.43 | 0.85 | 28.24% |

| 113 | 159 | -2755.21 | 0.85 | 30.85% |

| 130 | 7 | -3563.94 | 0.85 | 36.78% |

| 23 | 62 | -3781.95 | 0.85 | 48.81% |

| 85 | 64 | -4160.14 | 0.84 | 43.14% |

| 199 | 142 | -2843.12 | 0.84 | 33.75% |

| 194 | 7 | -3349.32 | 0.84 | 38.49% |

| 194 | 199 | -3228.83 | 0.84 | 37.74% |

| 56 | 109 | -3054.83 | 0.84 | 41.41% |

| 11 | 133 | -3689.75 | 0.83 | 44.20% |

| 30 | 18 | -7318.45 | 0.83 | 73.62% |

| 133 | 88 | -3584.39 | 0.83 | 38.31% |

| 143 | 116 | -3783.59 | 0.82 | 40.14% |

| 194 | 197 | -3543.94 | 0.82 | 39.40% |

| 173 | 136 | -3612.54 | 0.82 | 39.36% |

| 193 | 76 | -3170.82 | 0.82 | 35.38% |

| 29 | 12 | -8046.76 | 0.81 | 81.19% |

| 51 | 124 | -3370.63 | 0.81 | 38.79% |

| 97 | 197 | -2799.8 | 0.81 | 35.47% |

| 175 | 5 | -4164.02 | 0.81 | 42.68% |

| 48 | 137 | -3387.61 | 0.81 | 40.13% |

| 114 | 200 | -2869.77 | 0.81 | 35.76% |

| 146 | 183 | -4113.67 | 0.81 | 43.43% |

| 82 | 197 | -3002.75 | 0.8 | 39.90% |

| 81 | 164 | -3307.05 | 0.8 | 42.22% |

| 160 | 123 | -4194.54 | 0.8 | 44.72% |

| 80 | 171 | -3269.67 | 0.8 | 41.22% |

| 103 | 196 | -3136.7 | 0.79 | 37.65% |

| 5 | 129 | -5393.04 | 0.78 | 57.37% |

| 6 | 96 | -7150.45 | 0.74 | 74.04% |

| 2 | 185 | -5951.95 | 0.71 | 61.54% |

| 6 | 15 | -9998.1 | 0.7 | 99.98% |

| 2 | 154 | -6871.51 | 0.69 | 69.29% |

| 2 | 49 | -9998.26 | 0.68 | 99.98% |

| 2 | 82 | -9544.59 | 0.67 | 97.27% |

まとめ

検証結果からのまとめとして、今回検証した期間においては時間軸が小さくなるほどゴールデンクロスとデッドクロスの優位性がなくなるということがわかります。移動平均線の期間設定を考える場合、なんとなくみんなが使っているからという理由ではなく、データに基づく優位性のある期間を設定していくことで負けているトレーダーと差別化した手法を構築することができます。

「fx 移動平均線 設定 おすすめ」などでググってみるとわかりますが、通貨ペアや時間軸に関係なく期間20、50、75、100といったものが推奨されています。

しかしほとんどのブログでは、推奨する期間の裏付けとなるデータは一切公開されず、都合のいいチャート場面だけを切り抜いていかにも稼げるように解説しています。バックテストをすれば過去において優位性があるかないかは一目瞭然です。そういった情報であなたが稼げているのであれば問題ありませんが、ほとんどのトレーダーが稼げていないというのが現実だと思います。常識を疑えではないですが、成功者の多くは人と違う視点から物事を観察しています。

移動平均線を使ってセットアップやトリガーの一部として組み込む際に上記データが役立つかもしれません。裁量手法を構築する際の参考データとしてご活用ください。

コメント